To make sure that online thefts are reduced to nil, RBI has issued new guidelines from Oct 1st, 2020. ICICI Bank Credit Card helps to pay your EMI, electricity, mobile recharge easily using UPI apps.

In these COVID 2019 times, Internet Banking is for contactless transactions and banking. Customer Care also has also reduced the number of support requests. Credit Card is useful if you can make regular payments.

According to which, the customer can set international transactions, online transactions as well as contactless card transactions limits on their credit cards. This applies to ICICI Bank also.

You can register for different services like opt-in, opt-out and spend limits. There are different types of credit cards in ICICI. Making use of the Net banking account and mobile app, you can easily set the spend limit.

Also Read

Some of the types of ICICI credit card are –

- Platinum

- Titanium

- Preferred

- British Airways Classic

- Ascent American Express

- Platinum Identity

- Visa Signature

Indians customers also are eligible for most of them. If you have a high end credit card with a big card limit, it makes a good thing to keep it low. Also, you can make sure you disable the card for ATM and other transactions, if not required.

If your main purpose is to do online transactions to get heavy discounts, then you can leave it like that. Then, reduce the ICICI credit card transaction limit, so you have no problem with fraud.

Also Read –

I’m currently using the Visa Platinum card.

In this tutorial, we shall see how to set transaction limits in ICICI credit cards.

Set Spend Limit and Transaction Type in ICICI Credit Card

You can easily set the ATM, Online, International Transaction limits using Net banking. This is also possible with ICICI Credit Card. You just have to change few options in the dashboard section. Reduce the amount of transaction and disable type if not required. This will show the steps on how to do it.

Total Time: 5 minutes

Login to your ICICI Net Banking account using your login and password.

Click on Card & Loans > Credit Cards.

View and Manage your Credit Cards on the left.

Click on the Manage your Card tab.

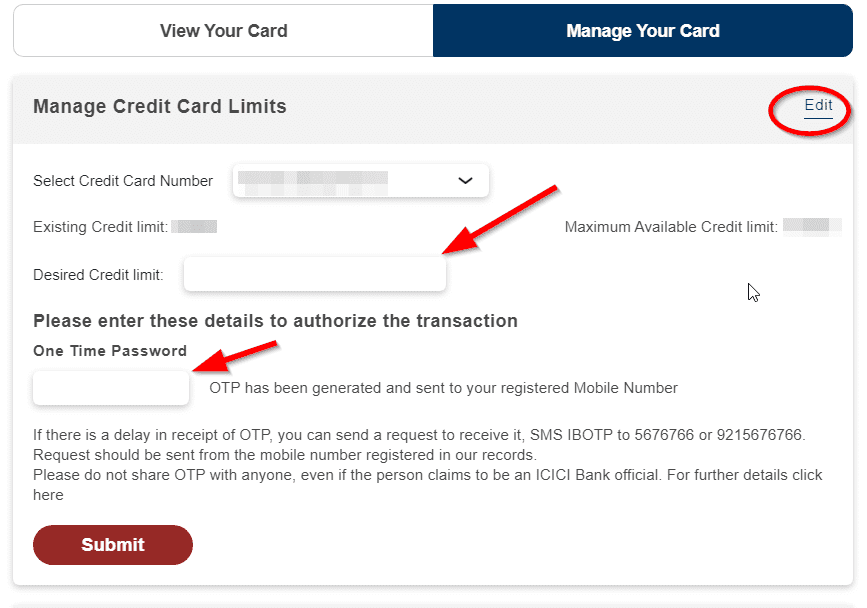

Two things can be done here – 1. Manage Credit Card Limits 2. Manage Credit Card Usage

The following transaction types can be enabled/disabled for your card.

ATM Withdrawal

Online Transactions

International Transactions

Tap & Pay Transactions

Merchant Outlets

(Note: It may vary on your card type).

Click on “Edit” beside the second option to enable/disable the category type.

To set the credit limit, click on “Edit” on the first option.

An OTP is sent to your registered mobile number.

Enter the desired limit and click on “OK”.

Successful messages should be displayed.

Appropriate message will also be sent to your email id and mobile number.

![[Tutorial] : How to Setup VPN Server in Windows 10 and 7 [Built-In]](https://www.windowstechit.com/wp-content/images357/2012/09/vpn-server-setup-fields-windows-10-768x410.png)